Back

Forward

Stripe

Usage

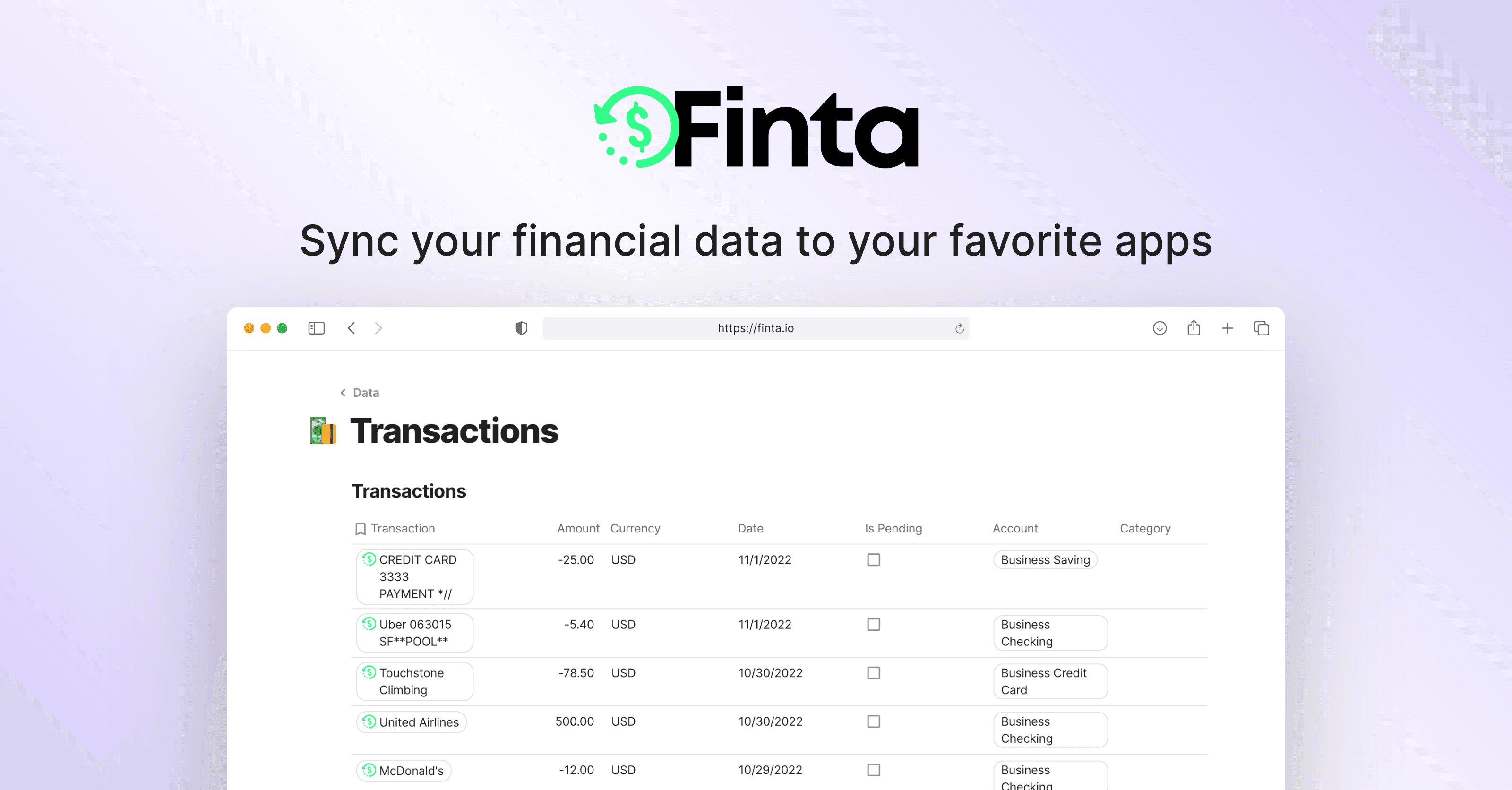

Financial management

Financial management

Pricing

Percentage

Likenesses

Paypal

Stripe Overview:

1. Introduction: Stripe, established in 2010 by Patrick and John Collison, is a leading technology company specializing in online payment processing. Widely adopted, it offers a robust platform for businesses seeking seamless internet-based transactions.

2. Payment Processing:

Online Payments: Stripe facilitates online payment acceptance for various business models, including e-commerce and subscription services.

International Transactions: With support for multiple currencies, Stripe simplifies global transactions for businesses.

3. Products and Services:

Stripe Payments: The core service for accepting and managing online payments.

Stripe Connect: Tailored for marketplaces, it enables secure transactions among multiple parties.

Stripe Billing: Manages subscriptions, invoices, and recurring billing.

Stripe Radar: A machine learning-based fraud prevention tool.

Stripe Atlas: Assists entrepreneurs in launching and growing online businesses, offering incorporation and banking solutions.

4. Developer-Friendly:

Renowned for its developer-friendly approach, Stripe provides a suite of APIs for seamless integration into websites and applications.

5. Security:

Stripe prioritizes security and compliance, employing encryption and industry-standard practices to safeguard sensitive data.

6. User Interface:

Users access a intuitive dashboard for monitoring transactions, generating reports, and managing payment processing.

7. Mobile Payments:

Stripe supports mobile payments, allowing businesses to seamlessly process transactions through mobile apps.

8. Supported Platforms:

Integratable across diverse platforms, including websites, mobile apps, and various e-commerce platforms.

9. Fee Structure:

Businesses are charged transaction fees by Stripe, with rates varying based on factors such as country, currency, and transaction type.

10. Partnerships:

Through strategic partnerships, Stripe enhances its offerings, collaborating with other companies and platforms to provide additional services.

In summary, Stripe's popularity stems from its user-friendly design, flexibility, and comprehensive toolset, positioning it as a key player in the fintech industry. It caters to businesses of all sizes globally, offering a reliable solution for online payment processing.

Back

Forward

Stripe

Usage

Financial management

Financial management

Pricing

Percentage

Likenesses

Paypal

Stripe Overview:

1. Introduction: Stripe, established in 2010 by Patrick and John Collison, is a leading technology company specializing in online payment processing. Widely adopted, it offers a robust platform for businesses seeking seamless internet-based transactions.

2. Payment Processing:

Online Payments: Stripe facilitates online payment acceptance for various business models, including e-commerce and subscription services.

International Transactions: With support for multiple currencies, Stripe simplifies global transactions for businesses.

3. Products and Services:

Stripe Payments: The core service for accepting and managing online payments.

Stripe Connect: Tailored for marketplaces, it enables secure transactions among multiple parties.

Stripe Billing: Manages subscriptions, invoices, and recurring billing.

Stripe Radar: A machine learning-based fraud prevention tool.

Stripe Atlas: Assists entrepreneurs in launching and growing online businesses, offering incorporation and banking solutions.

4. Developer-Friendly:

Renowned for its developer-friendly approach, Stripe provides a suite of APIs for seamless integration into websites and applications.

5. Security:

Stripe prioritizes security and compliance, employing encryption and industry-standard practices to safeguard sensitive data.

6. User Interface:

Users access a intuitive dashboard for monitoring transactions, generating reports, and managing payment processing.

7. Mobile Payments:

Stripe supports mobile payments, allowing businesses to seamlessly process transactions through mobile apps.

8. Supported Platforms:

Integratable across diverse platforms, including websites, mobile apps, and various e-commerce platforms.

9. Fee Structure:

Businesses are charged transaction fees by Stripe, with rates varying based on factors such as country, currency, and transaction type.

10. Partnerships:

Through strategic partnerships, Stripe enhances its offerings, collaborating with other companies and platforms to provide additional services.

In summary, Stripe's popularity stems from its user-friendly design, flexibility, and comprehensive toolset, positioning it as a key player in the fintech industry. It caters to businesses of all sizes globally, offering a reliable solution for online payment processing.

Back

Forward

Stripe

Usage

Financial management

Financial management

Pricing

Financial management

Likenesses

Financial management

Stripe Overview:

1. Introduction: Stripe, established in 2010 by Patrick and John Collison, is a leading technology company specializing in online payment processing. Widely adopted, it offers a robust platform for businesses seeking seamless internet-based transactions.

2. Payment Processing:

Online Payments: Stripe facilitates online payment acceptance for various business models, including e-commerce and subscription services.

International Transactions: With support for multiple currencies, Stripe simplifies global transactions for businesses.

3. Products and Services:

Stripe Payments: The core service for accepting and managing online payments.

Stripe Connect: Tailored for marketplaces, it enables secure transactions among multiple parties.

Stripe Billing: Manages subscriptions, invoices, and recurring billing.

Stripe Radar: A machine learning-based fraud prevention tool.

Stripe Atlas: Assists entrepreneurs in launching and growing online businesses, offering incorporation and banking solutions.

4. Developer-Friendly:

Renowned for its developer-friendly approach, Stripe provides a suite of APIs for seamless integration into websites and applications.

5. Security:

Stripe prioritizes security and compliance, employing encryption and industry-standard practices to safeguard sensitive data.

6. User Interface:

Users access a intuitive dashboard for monitoring transactions, generating reports, and managing payment processing.

7. Mobile Payments:

Stripe supports mobile payments, allowing businesses to seamlessly process transactions through mobile apps.

8. Supported Platforms:

Integratable across diverse platforms, including websites, mobile apps, and various e-commerce platforms.

9. Fee Structure:

Businesses are charged transaction fees by Stripe, with rates varying based on factors such as country, currency, and transaction type.

10. Partnerships:

Through strategic partnerships, Stripe enhances its offerings, collaborating with other companies and platforms to provide additional services.

In summary, Stripe's popularity stems from its user-friendly design, flexibility, and comprehensive toolset, positioning it as a key player in the fintech industry. It caters to businesses of all sizes globally, offering a reliable solution for online payment processing.